By Frik Els

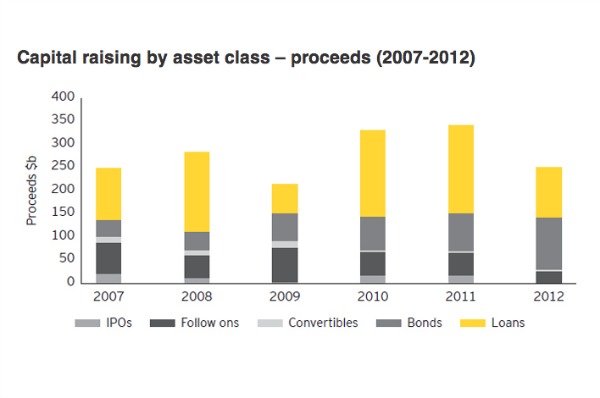

Mining and metal companies experienced a dismal 2012 on capital markets with the money raised dropping by more than 25% compared to 2011.

It was the first annual drop since the global financial crisis that started at the end of 2008, according to a new report by consultants Ernst & Young.

Ernst & Young estimates that the capital raised in the sector came to $249 billion last year, a sharp decline from the $340 billion in 2011. Mid-tier and junior companies were hardest hit.

The market for initial public offerings came to a virtual standstill says Ernst & Young with volumes down 40% and proceeds collapsing by more than 80% to just $1.3 billion.

This figure does not even include the Glencore float in 2011 that raised in excess of $10 billion.

Secondary equity issuance was just as dismal – widespread risk aversion saw a 48% reduction in proceeds to $26 billion and a reduction in average proceeds by junior companies to just $4m million, down from $6 million in 2011.

Things are not expected to improve either.

“The capital strike by many mining and metals companies in the face of rising costs and softer prices in 2012 will continue until commodity prices recover sufficiently to encourage new investment.” Lee Downham of Ernst & Young said.

Highlights from the report include:

- During 2012 we saw unprecedented demand from high-grade investment funds for primary debt issuance. Such demand was the result of substantial capital inflows from an increasingly risk averse investor universe, set against a backdrop of volatile markets and fragile economic news flow.

- Investment grade borrowers took full advantage of this flight to quality as they secured long-dated debt capital at pricing levels many banks struggled to match. Investment grade issues totalled $77b for the year, exceeding the 2011 figure of $60b, as the large cap producers raised capital for organic growth and to refinance existing debt.

- The high yield bond market was volatile due to its sensitivity to news-driven sentiment. This limited capital flow to the sector’s mid-tier companies, and increased the cost of borrowing, with average spreads on high yield debt widening by some 200bps compared with 2011.

- Equity markets suffered in the face of economic and political turbulence. IPO markets were practically closed on anything other than highly-dilutive terms, with a year-on-year 40% fall in volume and 81% decline in proceeds, even excluding Glencore. The $305m IPO of Ivanplats on the Toronto Stock Exchange (TSX) in October was the year’s bright spot.

- We also saw a significant fall in total loan proceeds to $104b from $187b in 2011, as banks reduced their exposure to risk assets in response to increased capital requirements under Basel III. This was met with less demand from investment grade companies, opting to secure bond finance often on more favorable terms.

- The reduced availability of bank loans increased borrowing costs and restrictive covenants for all but the largest companies, with average spreads on leveraged loans widening to 391bps above the benchmark, from 266bps in 2011.

…read more

Source: Mining.com- Copper News