For months now, analysts like Reuters and the Copper Study Group have been calling for a copper surplus, citing lower demand and rising production. However, at the end of October warehouses reported a 55% drop in their stocks this year, hitting 161,050 tonnes, or about three days’ worth of global consumption.

For months now, analysts like Reuters and the Copper Study Group have been calling for a copper surplus, citing lower demand and rising production. However, at the end of October warehouses reported a 55% drop in their stocks this year, hitting 161,050 tonnes, or about three days’ worth of global consumption.

So who is buying up all the copper?

Copper Investing News reports:

“It appears that China’s State Reserves Bureau (SRB) is still stockpiling copper. After buying 200,000 tonnes of copper in March and April, when copper was at its weakest price in years, the Bureau recently placed orders for 150,000 to 200,000 tonnes of copper cathode.

Beyond that, the refinement of copper has not experienced a surplus, but rather been delayed partly from the bottleneck of raw materials in Indonesia and China’s inability to smelt the metal themselves.

Although it might be premature to to call for a deficit, some bullish investors – along with China’s SRB – appear to be taking note of the tighter than anticipated market.

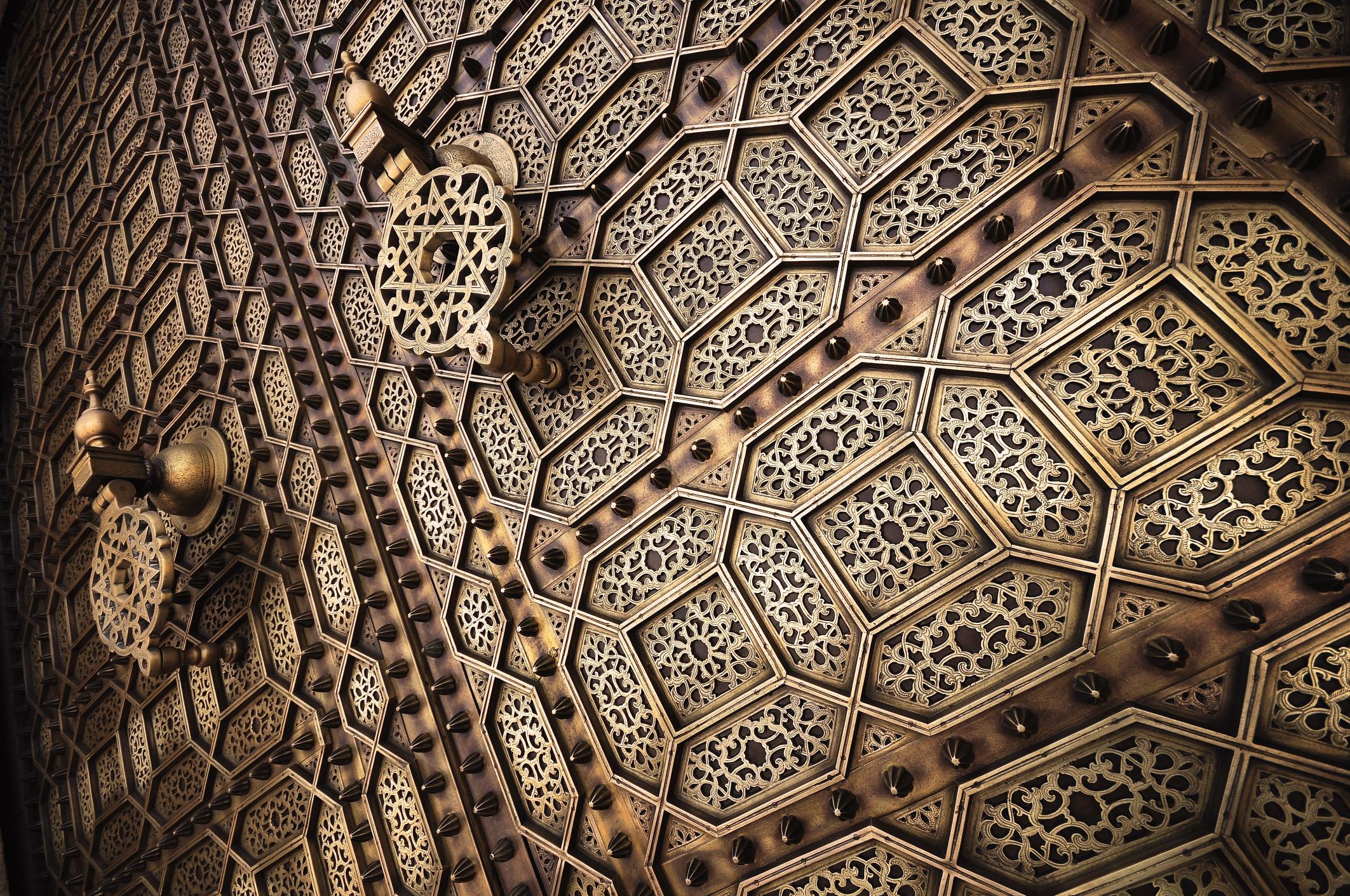

Photo courtesy of CopperInvestingNews.com