Forbes contributor James Gruber discusses where he thinks the next great contrarian trade may be, pointing specifically to junior gold stocks. Even with junior gold miners obliterated, down 80% since the 2011 peak due to declining gold prices, production shortfalls, cost blow-outs, dilutive capital raises and “too many snake oil salesmen disguised as CEOs,” he says there are signs that things may be turning around. In Gruber’s view there are two key drivers for gold prices:

- The so-called fear trade: the prospect of the financial system breaking down and currencies again being backed by gold; and

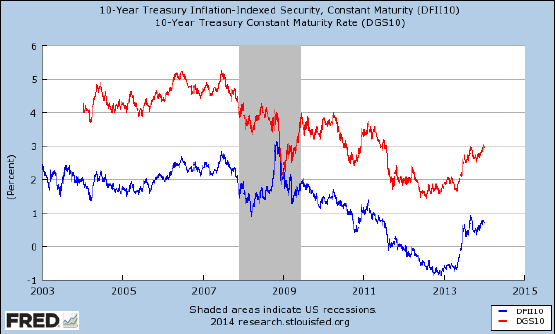

- Negative real bond yields.

Both of these factors are making gold a less valuable asset, at least for now. But gold bugs could very well have the last laugh. Read more…